Special Considerations for Coastal Properties: North Carolina Hurricane Insurance

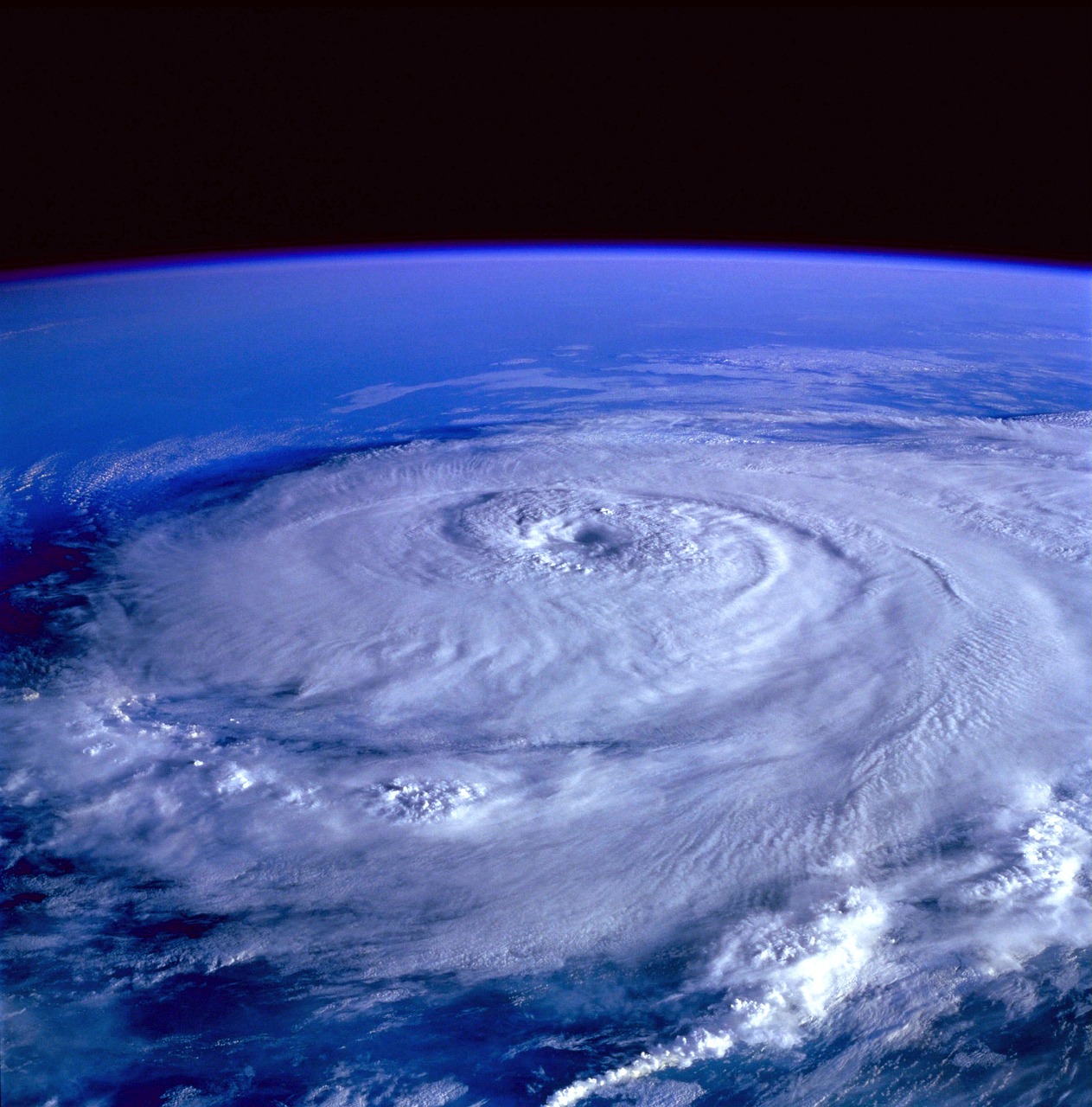

Living on the coast of North Carolina is a dream come true for many, with its picturesque beaches and stunning ocean views. However, along with the natural beauty comes the risk of hurricanes and tropical storms, which can wreak havoc on coastal properties. Homeowners in this area should consider a robust insurance policy to combat these weather-related risks.

What Is Hurricane Insurance?

Hurricane insurance generally refers to coverage that pairs with home insurance to provide greater protection against hurricanes. Such coverage can be critical in protecting coastal properties, as standard homeowners insurance policies often exclude damage caused by hurricanes or tropical storms. To address this gap, homeowners in coastal areas may need to secure coverage specifically tailored for hurricanes.

Insurance Considerations for Coastal Property Owners

The following are some standard coverage options available for homeowners in areas that are susceptible to hurricanes:

- Homeowners insurance may help pay for damages to your home, other structures and personal property in accordance with your policy. Depending on where you live, you may be required to have a specific hurricane deductible that would apply to certain hurricane-related property damages.

- Flood insurance may help pay for flood-related damages after a hurricane. Flood damage is typically excluded from a standard homeowners policy, making flood coverage vital to protect against hurricanes.

- Windstorm insurance may help pay for damages related to high winds, often present during hurricanes. While home insurance may offer some protection in this area, reviewing your policy for any relevant exclusions or limitations is essential.

Additionally, consider adding a sewer backup endorsement to your homeowners insurance policy, which may protect homes from losses caused by water or waterborne material discharge from a sewer, drain or sump. Coastal property owners should also regularly review and update their hurricane insurance policies to ensure they reflect the current value of their property and possessions. As property values and replacement costs can change over time, it’s crucial to stay up to date to avoid being underinsured.

Where Can I Get Hurricane Insurance in Havelock, New Bern and Morehead, NC?

By understanding the risks, choosing the right coverage, and taking proactive measures, homeowners can safeguard their coastal investments and enjoy the beauty of North Carolina’s coastline with peace of mind. Contact Amato Insurance Group to discuss your insurance needs. With over a decade of experience serving homeowners, families and businesses, the dedicated staff at Amato Insurance Group is well-equipped to help you assess and address your coverage needs. We can help you learn more about hurricane insurance options and get a personalized quote.

This blog is intended for informational and educational use only. It is not exhaustive and should not be construed as legal advice. Please contact your insurance professional for further information.

Categories: Blog