Do I Need Hurricane Insurance if I Already Have Homeowners Insurance?

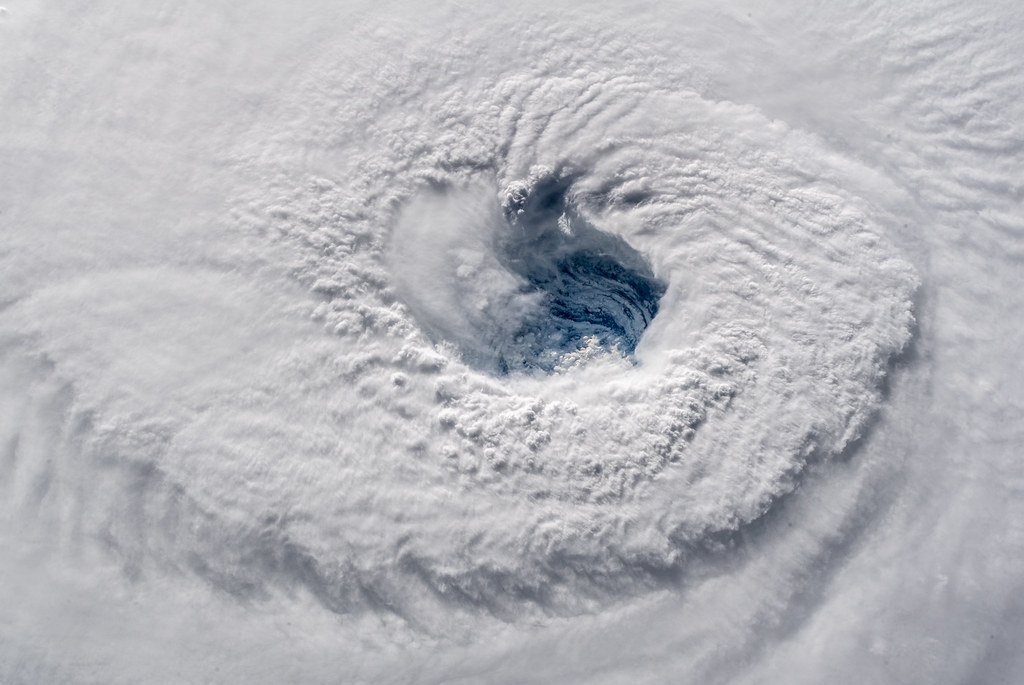

Hurricanes are a significant threat to your property and financial wellness. Like any significant investment, your home must be protected by suitable insurance policies. With that in mind, you must ensure that you have a complete understanding of your coverage’s limitations and capabilities. When it comes to hurricanes, it’s necessary to realize that standard homeowners insurance should not always be relied on to provide adequate coverage. As such, additional financial protection for losses arising from these severe storms may be essential with hurricane insurance.

Are Hurricanes Covered Under My Homeowners Insurance?

Given the catastrophic losses a hurricane may inflict on your home and property, having reliable coverage for such events should be a top priority. While some homeowners insurance policies may include coverage for some damage caused by hurricanes, such as wind-related losses, many either partially or entirely exclude some incidents.

If you live in an area prone to hurricanes and tropical storms, it may be more likely that wind-related property damage is specifically omitted from standard homeowners insurance. If your homeowners insurance policy does exclude damage caused by heavy winds, such as those caused by a hurricane, you should talk to your agent about adding an endorsement to your coverage.

Hurricanes may also cause significant flooding events. If external water seeps into your home, standard homeowners insurance policies generally don’t cover the resulting losses. Even an inch of floodwater can cause devastating damage to your home and belongings. As such, you should strongly consider purchasing a flood insurance policy, which is available either from private insurers or through the National Flood Insurance Program.

What Is a Hurricane Deductible?

Even if you have acquired suitable flood and windstorm coverage as part of your homeowners insurance policy, you may still have to pay additional funds out of pocket to cover hurricane-related losses. This is because many insurers require residents in areas prone to hurricanes to have a separate deductible for losses arising from these storms. As such, even if you have previously reached your homeowners policy’s deductible for other incidents, you must pay out of pocket until your hurricane deductible is met before receiving financial aid.

Get the Right Coverage

We’re here to help. At Amato Insurance Group, our dedicated agents have the knowledge and experience to help homeowners in Havelock, New Bern and Morehead acquire suitable coverage for hurricanes. Visit our website or call one of our offices today to get started

This blog is intended for informational and educational use only. It is not exhaustive and should not be construed as legal advice. Please contact your insurance professional for further information.

Categories: Blog